Delving into aaa home insurance nj, this introduction immerses readers in a unique and compelling narrative. AAA Home Insurance in New Jersey offers a range of coverage options, benefits, and exceptional customer service tailored to meet the needs of homeowners in the state. From detailed insights into the claims process to additional services provided, this overview aims to provide a comprehensive understanding of AAA Home Insurance in New Jersey.

Overview of AAA Home Insurance in New Jersey: Aaa Home Insurance Nj

AAA offers a range of home insurance coverage options tailored to meet the needs of homeowners in New Jersey. From standard coverage to additional protections, AAA aims to provide comprehensive insurance solutions for its customers in the state.

Coverage Options Provided by AAA Home Insurance in NJ

- Standard Coverage: AAA’s home insurance typically includes coverage for the structure of the home, personal belongings, liability protection, and additional living expenses in case of a covered loss.

- Additional Protections: AAA also offers optional coverage for things like valuable items, water backup, identity theft, and more to customize the policy according to individual needs.

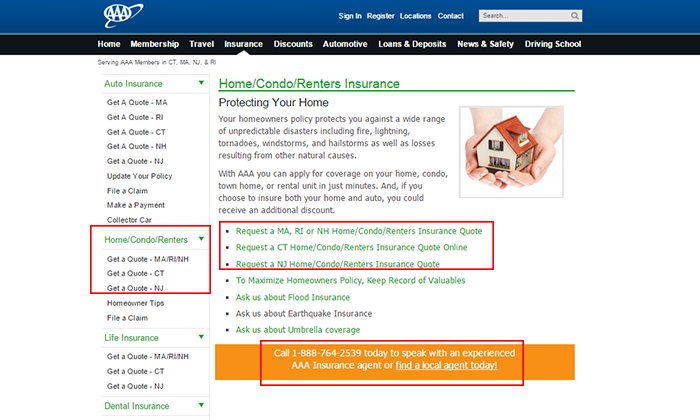

Obtaining a Quote for Home Insurance from AAA in New Jersey

To get a quote for home insurance from AAA in New Jersey, homeowners can visit the AAA website, call their local AAA agent, or visit a AAA branch office to discuss their insurance needs. The process typically involves providing information about the property, desired coverage options, and personal details to receive a customized quote.

Cost and Coverage Comparison with Other Providers in the State

When comparing the cost and coverage of AAA home insurance with other providers in New Jersey, it’s essential to consider factors such as the level of coverage, deductible options, discounts available, and customer service reputation. While AAA may offer competitive rates and comprehensive coverage, it’s recommended to obtain quotes from multiple insurers to ensure you’re getting the best value for your home insurance needs.

Benefits of choosing AAA home insurance in New Jersey

When it comes to choosing home insurance in New Jersey, AAA offers a range of exclusive benefits that set them apart from other providers.

Exclusive Benefits

- AAA provides coverage for additional living expenses in case your home becomes uninhabitable due to a covered loss.

- Policyholders can benefit from AAA’s exceptional customer service and claims handling process, ensuring a smooth experience during stressful times.

- AAA offers personalized coverage options to tailor the policy to your specific needs, giving you peace of mind knowing you are adequately protected.

Discounts Available

- AAA offers a variety of discounts to homeowners in New Jersey, such as multi-policy discounts for bundling home and auto insurance.

- Policyholders can also save by installing security devices, like alarms and deadbolts, to reduce the risk of theft or damage.

- Additionally, AAA rewards loyal customers with discounts for renewing their policies year after year.

Customer Reviews

Many homeowners in New Jersey have praised AAA for their responsive customer service, quick claims processing, and competitive rates. Customers appreciate the peace of mind that comes with having AAA as their insurance provider.

Understanding the claims process with AAA home insurance in New Jersey

When it comes to filing a claim with AAA for home insurance in New Jersey, it is essential to understand the steps involved, the turnaround time for processing claims, and how disputes or issues related to claims are handled by AAA.

Steps involved in filing a claim with AAA for home insurance

- Contact AAA as soon as possible to report the claim and provide all necessary details.

- An AAA claims representative will guide you through the process and may schedule an inspection of the damage.

- Submit any required documentation, such as photos, estimates, and receipts, to support your claim.

- AAA will assess the claim and determine coverage based on the policy terms and conditions.

- Once the claim is approved, AAA will work on resolving the claim and provide the necessary assistance.

Typical turnaround time for processing claims in New Jersey, Aaa home insurance nj

AAA aims to process claims efficiently, and the turnaround time can vary based on the complexity of the claim and the extent of damage. In general, claims are processed promptly to ensure timely assistance to policyholders.

How AAA handles disputes or issues related to home insurance claims in the state

- AAA has a dedicated claims department to handle disputes or issues that may arise during the claims process.

- Policyholders can reach out to AAA to discuss any concerns or disagreements regarding the claim settlement.

- AAA will investigate the matter thoroughly, considering all relevant information and policy provisions.

- If a resolution cannot be reached through discussions, AAA may involve mediation or arbitration to resolve the dispute fairly.

Additional services and resources offered by AAA for homeowners in New Jersey

AAA Home Insurance in New Jersey goes beyond just providing coverage for your property. They offer additional services and resources to help homeowners protect their homes and prepare for any unexpected events.

Additional Coverage Options and Add-ons

AAA Home Insurance customers in New Jersey have access to a range of additional coverage options and add-ons to customize their policy. These may include coverage for valuable items, identity theft, water backup, and more.

Home Maintenance Tips and Resources

AAA provides helpful home maintenance tips and resources to policyholders to help them keep their homes in top condition. From seasonal maintenance checklists to guides on how to prevent common issues, homeowners can benefit from these resources to protect their investment.

Preparation for Natural Disasters or Emergencies

AAA assists homeowners in New Jersey in preparing for natural disasters or emergencies by offering resources on emergency preparedness. From creating a home inventory to developing an evacuation plan, AAA helps homeowners take proactive steps to safeguard their families and properties.

Last Word

In conclusion, AAA Home Insurance in New Jersey stands out as a reliable and customer-centric choice for homeowners in the state. With a focus on comprehensive coverage, exclusive benefits, and efficient claims processing, AAA proves to be a valuable partner in safeguarding your home and belongings. Whether you are looking for additional services or seeking peace of mind during emergencies, AAA Home Insurance in New Jersey has you covered.

FAQ Overview

What coverage options does AAA Home Insurance offer in New Jersey?

AAA Home Insurance in New Jersey provides coverage for dwelling, personal property, liability, and additional living expenses.

Are there any discounts available for AAA Home Insurance policyholders in New Jersey?

AAA offers discounts for various factors such as bundling policies, having a home security system, and being claims-free.

How does AAA handle disputes or issues related to home insurance claims in New Jersey?

AAA has a structured process for handling disputes, including internal reviews and escalation procedures to ensure fair resolutions.

What additional coverage options are available for AAA Home Insurance customers in New Jersey?

AAA offers add-ons like identity theft protection, equipment breakdown coverage, and guaranteed home replacement cost.

Does AAA provide resources for homeowners in New Jersey to prepare for natural disasters?

AAA offers resources and tips to help homeowners prepare for natural disasters and emergencies, ensuring they are ready to handle such situations effectively.