Commute or pleasure car insurance reddit brings to light the distinctions between these two types of coverage, shedding light on factors that influence insurance rates and providing valuable insights from the Reddit community. As we delve into this topic, we explore how insurance companies differentiate between the two, factors affecting insurance rates, and tips for selecting the right coverage.

Additionally, we uncover experiences and recommendations from Reddit users, along with emerging discussions and trends in the car insurance realm on this popular platform.

Understanding Commute vs. Pleasure Car Insurance

When it comes to car insurance, understanding the difference between commute and pleasure car insurance is crucial. Commute car insurance is designed for individuals who drive their vehicles to work or for business purposes, while pleasure car insurance is intended for drivers who use their vehicles for recreational purposes.

Examples of Commute Car Insurance

- Individuals who drive to work every day

- Delivery drivers who use their vehicles for work-related purposes

- Real estate agents who drive to multiple properties during the day

Examples of Pleasure Car Insurance

- Retirees who use their vehicles for leisurely drives

- Individuals who only use their vehicles on weekends

- Drivers who only use their vehicles for personal errands and outings

How Insurance Companies Differentiate

Insurance companies differentiate between commute and pleasure car insurance by analyzing factors such as the driver’s daily mileage, the purpose of vehicle use, and the risk associated with each type of usage. Commute car insurance typically comes with higher premiums due to the increased risk of accidents associated with daily commuting.

Factors Influencing Insurance Rates

When it comes to determining insurance rates for both commute and pleasure car insurance, several factors come into play. These factors can significantly impact the cost of your premiums, making it essential to understand how they work.

Mileage and Usage Patterns

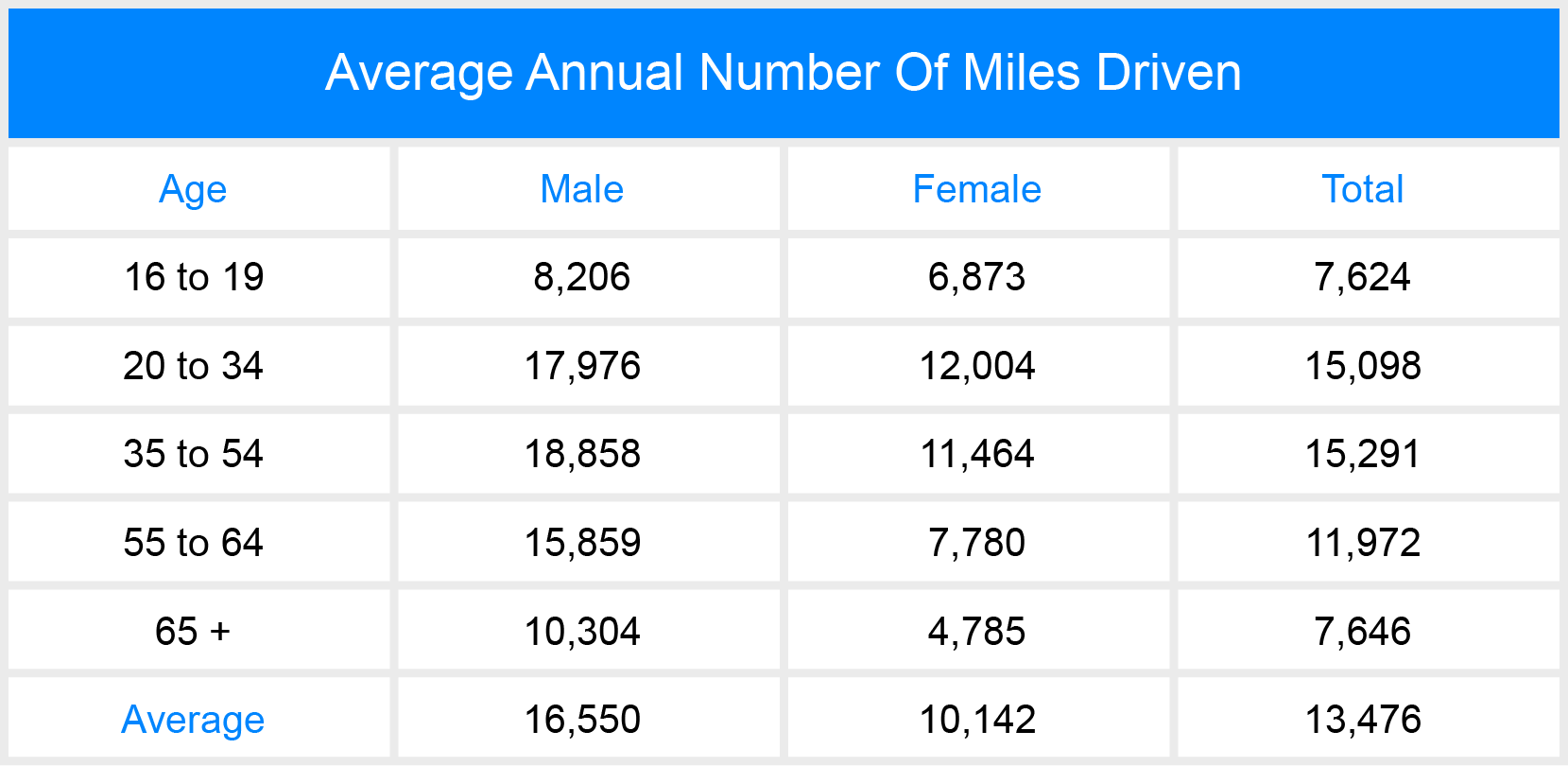

- The number of miles you drive annually can affect your insurance rates. Typically, the more you drive, the higher the risk of accidents, leading to higher premiums.

- Insurance companies consider your usage patterns, such as whether you mainly drive for work or leisure. Commuting long distances daily poses a higher risk compared to using your car for occasional weekend trips.

- Providing accurate information about your mileage and usage patterns is crucial to ensure you are adequately covered and paying the right premium.

Driving Habits, Commute or pleasure car insurance reddit

- Insurance rates can also be influenced by your driving habits, including speeding tickets, accidents, and other traffic violations. Safe drivers typically qualify for lower premiums.

- Installing devices such as telematics can track your driving behavior, rewarding safe drivers with discounts on their insurance premiums.

- Improving your driving habits can not only keep you safe on the road but also help you save money on insurance costs in the long run.

Location of Residence

- The area where you live can impact your insurance rates due to varying levels of risk associated with different locations. Urban areas with higher traffic congestion and crime rates may result in higher premiums.

- Factors like weather conditions, frequency of accidents, and theft rates in your area can influence the cost of insurance. Rural areas or neighborhoods with lower crime rates may offer more affordable premiums.

- When obtaining insurance quotes, make sure to provide your accurate address to receive the most relevant and competitive rates based on your location.

Choosing the Right Coverage

When it comes to selecting car insurance coverage, it is crucial to choose the right type based on your specific needs and usage of the vehicle. Whether you use your car for daily commuting or for pleasure purposes, understanding the coverage options available and their importance can help you make an informed decision.

Comparing Coverage Options

- Liability Coverage: This is the most basic form of car insurance and covers damages or injuries you cause to others in an accident.

- Collision Coverage: This type of coverage pays for repairs to your own vehicle in case of a collision with another vehicle or object.

- Comprehensive Coverage: Comprehensive insurance covers damages to your car from non-collision incidents like theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): PIP covers medical expenses for you and your passengers regardless of who is at fault in an accident.

Importance of Selecting Appropriate Coverage

- Choosing the right coverage ensures that you are adequately protected in case of an accident or unforeseen event, preventing financial hardships.

- Having the appropriate coverage can give you peace of mind and confidence while driving, knowing that you are prepared for any unexpected situations.

- Matching your coverage to your usage type (commute or pleasure) can help you save money by avoiding unnecessary coverage that does not apply to your driving habits.

Tips for Determining Optimal Coverage

- Assess your driving habits and usage of the vehicle to determine whether you primarily use it for commuting or pleasure purposes.

- Consider factors such as your daily mileage, where you park your car, and the typical driving conditions to gauge your risk level and coverage needs.

- Consult with an insurance agent to discuss your specific requirements and get personalized recommendations on the coverage options that best suit your situation.

- Regularly review and update your coverage to account for any changes in your driving habits, lifestyle, or vehicle value to ensure you have adequate protection at all times.

Reddit Community Insights

Reddit users often share their experiences and insights on various topics, including car insurance. When it comes to commute or pleasure car insurance, some common concerns, tips, and recommendations have emerged within the Reddit community. Let’s explore some of these insights below.

Common Concerns and Tips

- Many Reddit users advise others to accurately report their daily mileage to insurance companies to ensure they are getting the right coverage for their commute or pleasure driving.

- Some users recommend shopping around for car insurance quotes regularly to ensure they are getting the best rates for their specific driving habits.

- There is a discussion on the importance of understanding the difference between commute and pleasure car insurance to avoid any coverage gaps or overpayment.

Trends and Emerging Discussions

- One emerging trend on Reddit is the use of telematics devices by insurance companies to track driving habits and offer personalized insurance rates based on actual driving behavior.

- There is a growing discussion on Reddit about the impact of autonomous vehicles on car insurance rates and coverage options in the future.

- Reddit users are also sharing tips on how to lower insurance rates by bundling policies, maintaining a good driving record, and taking advantage of discounts offered by insurance companies.

Outcome Summary: Commute Or Pleasure Car Insurance Reddit

In conclusion, understanding the nuances of commute and pleasure car insurance is crucial for making informed decisions about coverage. By considering the various factors influencing insurance rates and leveraging insights from the Reddit community, individuals can tailor their coverage to suit their specific needs effectively.

Quick FAQs

What is the difference between commute and pleasure car insurance?

Commute car insurance typically covers driving to and from work or school, while pleasure car insurance is for personal use only, excluding regular commuting.

How do insurance companies differentiate between commute and pleasure car insurance?

Insurance companies analyze factors like mileage, usage patterns, and driving habits to determine the type of coverage needed.

What factors influence insurance rates for commute and pleasure car insurance?

Factors such as mileage, driving habits, and location of residence can affect insurance rates for both types of coverage.