Humana health insurance medicare supplement sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

When it comes to making informed decisions about your healthcare coverage, understanding the ins and outs of Humana’s Medicare supplement plans is crucial. From coverage options to costs and customer satisfaction, this guide will walk you through everything you need to know.

Introduction to Humana Health Insurance Medicare Supplement

Humana Health Insurance Medicare Supplement provides additional coverage beyond what original Medicare offers. It helps fill the gaps in healthcare costs that Medicare does not cover, giving beneficiaries peace of mind and financial protection.

Importance of Medicare Supplement Plans

Medicare supplement plans are crucial for covering out-of-pocket expenses such as deductibles, copayments, and coinsurance that Medicare beneficiaries would otherwise have to pay themselves. These plans help ensure comprehensive healthcare coverage and protect individuals from unexpected medical costs.

Benefits of Choosing Humana for Medicare Supplement Coverage

- Wide Network: Humana has a vast network of healthcare providers, giving beneficiaries more options for care.

- Customizable Plans: Humana offers a variety of Medicare supplement plans to suit individual needs and budgets.

- Additional Benefits: Some Humana plans may include extras like vision, dental, and fitness benefits.

- Financial Stability: With Humana’s reputation for financial stability, beneficiaries can trust that their coverage will be reliable.

Coverage Options Offered by Humana

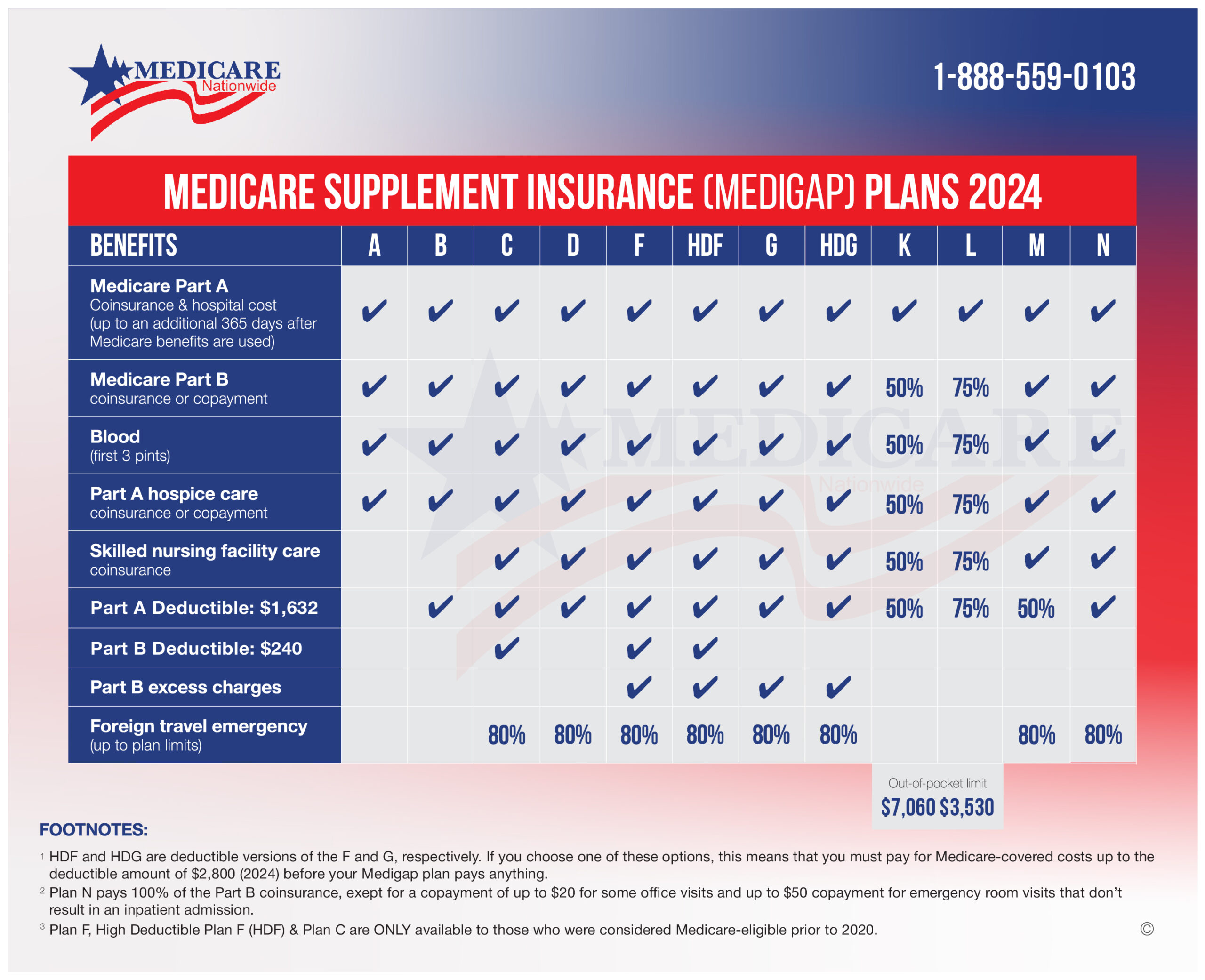

When it comes to Medicare supplement plans, Humana offers a range of options to meet the diverse needs of individuals looking to enhance their original Medicare coverage. Each plan provides different levels of coverage and benefits, allowing customers to choose the one that best suits their healthcare needs and budget.

Different Medicare Supplement Plans Offered by Humana

- Plan A: This basic plan covers essential benefits such as Medicare Part A coinsurance and hospital costs.

- Plan B: In addition to the benefits covered under Plan A, Plan B also includes coverage for Medicare Part A deductible.

- Plan C: Plan C offers comprehensive coverage, including benefits for skilled nursing facility care, Medicare Part B deductible, and foreign travel emergencies.

- Plan F: Considered the most comprehensive plan, Plan F covers all gaps in Medicare, leaving you with minimal out-of-pocket expenses.

- Plan G: Similar to Plan F but without coverage for the Medicare Part B deductible, Plan G is a popular choice among beneficiaries looking for comprehensive coverage.

- Plan N: This plan offers a cost-sharing structure, with copayments for some services, making it a more budget-friendly option for those willing to pay small out-of-pocket costs.

Comparison of Coverage Benefits between Different Humana Plans

| Plan | Coverage |

|---|---|

| Plan A | Basic benefits like Medicare Part A coinsurance and hospital costs. |

| Plan F | Comprehensive coverage including all Medicare gaps and minimal out-of-pocket expenses. |

| Plan N | Cost-sharing with copayments for some services to reduce overall expenses. |

Unique Features or Add-ons Available with Humana’s Plans

Humana offers additional benefits such as SilverSneakers fitness program, access to telehealth services, and a prescription drug discount program for their Medicare supplement plan members.

Eligibility and Enrollment Process

When it comes to Humana Health Insurance Medicare Supplement, it is important to understand who is eligible to enroll and the process involved.

Eligibility for Humana Health Insurance Medicare Supplement

- Individuals who are already enrolled in Medicare Part A and Part B are eligible to enroll in a Humana Health Insurance Medicare Supplement plan.

- Most states require individuals to be at least 65 years old to qualify for enrollment.

- Individuals under 65 may be eligible if they have certain disabilities or medical conditions.

Enrollment Process with Humana

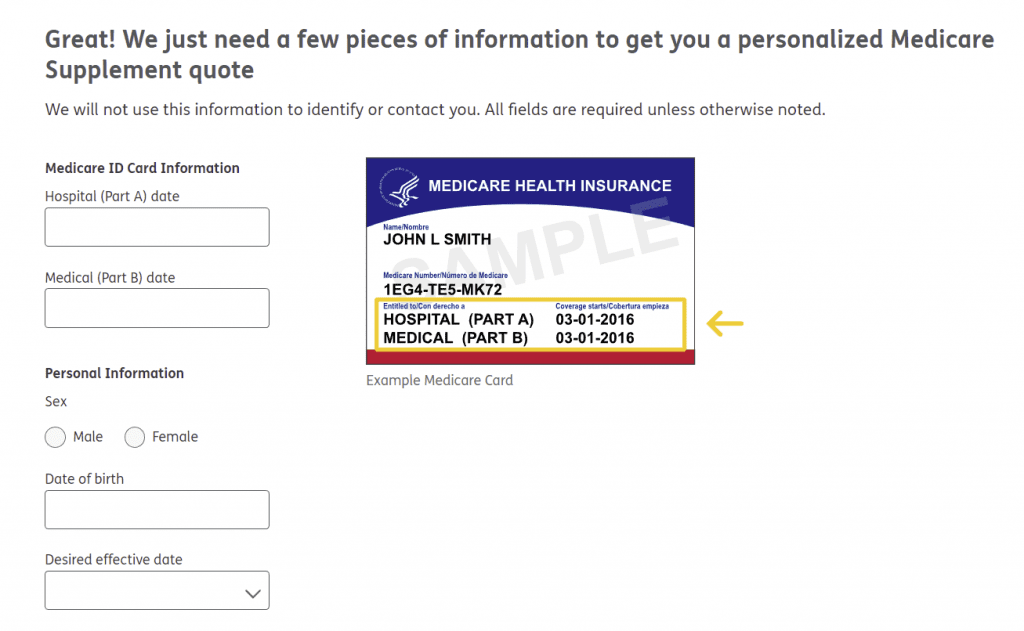

- To enroll in a Humana Health Insurance Medicare Supplement plan, you can visit the Humana website or contact their customer service team for assistance.

- You can also enroll during your Initial Enrollment Period (IEP) which starts three months before you turn 65, includes your birthday month, and ends three months after.

- If you miss your IEP, there are other enrollment periods available such as the Annual Enrollment Period (AEP) or Special Enrollment Periods (SEP) for specific circumstances.

Requirements and Considerations for Enrollment

- It is important to have both Medicare Part A and Part B active before enrolling in a Humana Health Insurance Medicare Supplement plan.

- You may need to provide personal information, such as your Medicare number, to complete the enrollment process.

- Consider factors such as monthly premiums, coverage options, and network providers when choosing a plan that best suits your needs.

Cost and Pricing Structure

When it comes to Humana’s Medicare supplement plans, understanding the cost and pricing structure is crucial for making an informed decision. Let’s break down the costs associated with Humana’s plans, compare pricing between different plans or with other providers, and discuss factors that can influence the pricing of Humana’s plans.

Cost Breakdown of Humana’s Medicare Supplement Plans

- Humana offers different Medicare supplement plans, each with its own set of coverage and corresponding costs.

- The costs associated with Humana’s plans typically include premiums, deductibles, copayments, and coinsurance.

- Premiums are the monthly payments you make to maintain your coverage, while deductibles are the amount you must pay out of pocket before your coverage kicks in.

- Copayments and coinsurance are additional costs that you may incur when receiving healthcare services.

Price Comparison with Other Providers

- It’s essential to compare the pricing of Humana’s Medicare supplement plans with those offered by other insurance providers to ensure you’re getting the most competitive rates.

- Factors such as your age, location, and health status can influence the pricing of Medicare supplement plans, so it’s important to shop around for the best deal.

- Humana may offer competitive pricing for certain plans, but it’s always wise to compare quotes from multiple providers to find the most cost-effective option for your needs.

Factors Influencing Pricing of Humana’s Plans

- Humana’s pricing for Medicare supplement plans may be influenced by factors such as the level of coverage offered, the geographic location of the policyholder, and the applicant’s age and health status.

- Some plans may have higher premiums but offer more comprehensive coverage, while others may have lower premiums with fewer benefits.

- Your individual health needs and budget will ultimately determine which plan offers the best value for you, so it’s essential to consider all these factors when choosing a Medicare supplement plan.

Network Coverage and Provider Options

When considering a Medicare supplement plan, it is crucial to understand the network coverage provided by the insurance provider. In the case of Humana Health Insurance, they offer a wide network of healthcare providers and facilities to ensure you have access to quality care when needed.

Humana’s Network Coverage

Humana’s Medicare supplement plans typically work with a broad network of doctors, specialists, hospitals, and other healthcare providers across the country. This extensive network ensures that you have a wide range of options when seeking medical care.

- Primary care physicians

- Specialists such as cardiologists, oncologists, and more

- Hospitals and medical facilities

- Diagnostic centers and laboratories

Out-of-Network Coverage Options

While it is important to stay within the network to maximize coverage and minimize out-of-pocket costs, Humana also provides some out-of-network coverage options. This means that you may still receive partial coverage for healthcare services obtained outside of the network, although at a higher cost compared to in-network services.

It is essential to carefully review the details of out-of-network coverage, including any limitations or restrictions, before seeking care outside of Humana’s network.

Customer Satisfaction and Reviews

Customer satisfaction plays a crucial role in choosing the right Medicare supplement plan. Here’s a look at customer satisfaction ratings and reviews for Humana’s Medicare supplement plans.

Insights from Customer Reviews

- Many customers have praised Humana for its excellent customer service and easy claims process.

- Several reviews highlight the comprehensive coverage provided by Humana’s Medicare supplement plans.

- Customers appreciate the wide network of healthcare providers that accept Humana insurance.

Common Feedback and Complaints

- Some customers have reported issues with billing and payment processes, citing confusion over charges.

- A few reviews mention difficulties in finding in-network providers in certain areas.

- While most customers are satisfied with the coverage options, some have expressed a desire for more personalized plan choices.

Closure

In conclusion, Humana Health Insurance Medicare Supplement stands out as a reliable option for individuals seeking comprehensive coverage and excellent service. With a range of plans to choose from and a strong network of providers, Humana ensures that your healthcare needs are met with efficiency and care.

Questions Often Asked: Humana Health Insurance Medicare Supplement

Who is eligible for Humana Health Insurance Medicare Supplement?

Individuals aged 65 and older, or those under 65 with certain disabilities, may be eligible for Humana’s Medicare supplement plans.

What factors can influence the pricing of Humana’s plans?

Factors such as age, location, and the specific plan chosen can influence the pricing of Humana’s Medicare supplement plans.

Does Humana offer out-of-network coverage options?

Humana may offer out-of-network coverage options depending on the specific plan chosen. It’s important to review the details of each plan for more information.