Insurance options for small business owners sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Small business owners face unique challenges, and having the right insurance coverage can make all the difference in protecting their livelihood.

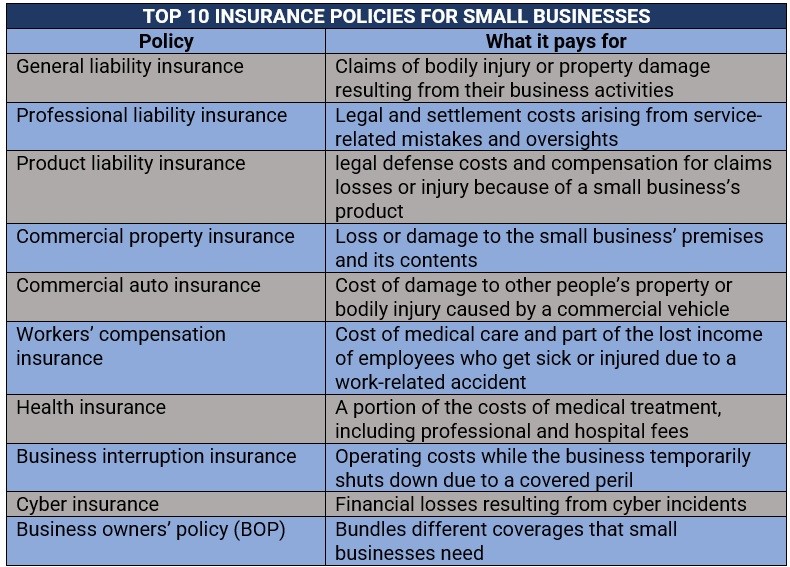

In this guide, we will delve into the various types of insurance available, such as general liability insurance, property insurance, workers’ compensation insurance, and business interruption insurance, tailored specifically for small businesses.

Overview of Insurance Options for Small Business Owners

Insurance is a crucial aspect for small business owners as it provides protection against unexpected events that could potentially harm their business financially. By investing in the right insurance coverage, small business owners can safeguard their assets, employees, and overall business operations.

Types of Insurance Available for Small Business Owners

- General Liability Insurance: This type of insurance protects small businesses from financial losses due to bodily injury, property damage, or advertising injury claims.

- Property Insurance: Property insurance covers physical assets such as buildings, equipment, inventory, and furniture from theft, damage, or destruction.

- Workers’ Compensation Insurance: This insurance provides coverage for medical expenses and lost wages for employees who are injured or become ill while on the job.

- Business Interruption Insurance: Business interruption insurance helps small businesses recover financially after a disaster or unexpected event forces them to temporarily close their operations.

Examples of Common Insurance Options for Small Businesses

- Professional Liability Insurance: Also known as errors and omissions insurance, this coverage protects small businesses from lawsuits related to professional services or advice provided.

- Commercial Auto Insurance: Small businesses with company vehicles should consider commercial auto insurance to cover any accidents, damages, or injuries involving their vehicles.

- Cyber Liability Insurance: With the increasing risk of cyber attacks, small businesses can benefit from cyber liability insurance to protect against data breaches, hacking, or other cyber-related incidents.

General Liability Insurance

General liability insurance is a type of coverage that helps protect small business owners from financial losses resulting from claims of bodily injury, property damage, and advertising injury.

What General Liability Insurance Covers

- Medical expenses for injuries that occur on the business premises

- Legal fees and settlements related to lawsuits for bodily injury or property damage

- Damage to third-party property caused by your business operations

- Claims of false advertising or copyright infringement

Why General Liability Insurance is Essential for Small Business Owners

General liability insurance is essential for small business owners because it provides financial protection against unexpected events that could lead to expensive lawsuits or settlements. Without this coverage, a single accident or lawsuit could potentially bankrupt a small business.

Comparison of Different Providers

| Insurance Company | Coverage Limits | Premium Costs | Customer Reviews |

|---|---|---|---|

| Company A | $1 million | $500/year | 4.5/5 stars |

| Company B | $2 million | $800/year | 4.0/5 stars |

| Company C | $500,000 | $400/year | 4.8/5 stars |

Property Insurance

Property insurance is essential for small business owners to protect their physical assets, such as buildings, equipment, inventory, and furniture, from unexpected events like fire, theft, vandalism, or natural disasters.

Coverage Provided by Property Insurance

Property insurance typically covers the cost of repairing or replacing damaged or stolen property, as well as any associated business interruption expenses. It can also provide coverage for equipment breakdowns, signage, and outdoor fixtures.

- Damage to buildings: Property insurance can help cover the cost of repairs or rebuilding if a small business owner’s building is damaged by a covered event.

- Loss of inventory: If inventory is damaged or destroyed, property insurance can help cover the cost of replacing the lost items.

- Business interruption: Property insurance can provide coverage for lost income if a covered event forces a small business to temporarily close.

Examples of Incidents Where Property Insurance is Beneficial

For example, if a small retail store experiences a fire that damages the building and destroys inventory, property insurance can help cover the cost of repairs, rebuilding, and replacing lost inventory.

Determining the Right Amount of Coverage

Small business owners should assess the value of their property, including buildings, equipment, inventory, and other assets, to determine the appropriate amount of coverage needed. It is essential to consider potential risks, such as the location of the business and the likelihood of specific events like natural disasters.

- Consult with an insurance agent or broker to evaluate the property and determine the replacement cost.

- Consider additional coverage options, such as flood insurance or earthquake insurance, depending on the business’s location and potential risks.

- Regularly review and update the coverage amount to ensure it aligns with the current value of the property and any changes in the business’s assets.

Workers’ Compensation Insurance: Insurance Options For Small Business Owners

Workers’ compensation insurance is a crucial coverage for small business owners as it provides protection for both employees and employers in the event of work-related injuries or illnesses. This type of insurance helps cover medical expenses, lost wages, and rehabilitation costs for employees who are injured on the job.

Importance of Workers’ Compensation Insurance

- Workers’ compensation insurance is required by law in most states, ensuring compliance with legal regulations.

- It helps protect small business owners from costly lawsuits and potential financial ruin in case of workplace accidents.

- By providing financial support to injured employees, it helps maintain a positive work environment and employee morale.

Obtaining Workers’ Compensation Insurance

- Small business owners can obtain workers’ compensation insurance through private insurance companies or state-operated insurance programs.

- They will need to provide details about their business operations, number of employees, and workplace safety measures to determine the coverage needed.

- Premiums for workers’ compensation insurance are typically based on the type of business, number of employees, and previous claims history.

Protecting Both Employees and Employers

- Workers’ compensation insurance ensures that employees receive proper medical care and compensation for lost wages without having to sue their employers.

- For employers, this insurance provides protection against legal costs, settlements, and potential fines resulting from workplace injuries.

- It fosters a safer work environment by incentivizing employers to implement safety measures and reduce the risk of accidents.

Business Interruption Insurance

Business Interruption Insurance is a type of coverage that helps small business owners recover from financial losses resulting from unexpected disruptions to their operations. This insurance can provide funds to cover ongoing expenses, payroll, and lost revenue during the period when the business is unable to operate.

Scenarios Where Business Interruption Insurance is Crucial, Insurance options for small business owners

- Natural Disasters: In the event of a flood, fire, hurricane, or earthquake that damages your business premises and forces you to close temporarily, business interruption insurance can help cover the resulting financial losses.

- Equipment Breakdown: If essential equipment or machinery malfunctions, causing a halt in operations, this insurance can provide financial support until the equipment is repaired or replaced.

- Supply Chain Disruption: When a key supplier experiences a disruption that affects your ability to continue production, business interruption insurance can help mitigate the financial impact.

Comparison of Coverage Options

| Standard Coverage | Extended Coverage |

|---|---|

| Provides coverage for a specified period of time following a covered event, such as a fire or natural disaster. | Offers additional coverage for scenarios like utility outages, civil authority closures, and contagious diseases. |

| Reimburses for lost profits and ongoing expenses based on historical financial data. | May include coverage for additional expenses incurred to expedite the resumption of business operations. |

| Typically has a waiting period before benefits kick in, usually 48 to 72 hours. | Can offer extended waiting periods or coverage for seasonal fluctuations in business income. |

End of Discussion

Exploring the realm of insurance options for small business owners reveals the crucial role that insurance plays in safeguarding their businesses. By understanding the different types of insurance and their significance, small business owners can make informed decisions to protect their assets and employees, ensuring the longevity of their enterprises.

Quick FAQs

What are some less common types of insurance that small business owners should consider?

Small business owners should also explore specialized insurance options like cyber liability insurance, professional liability insurance, and umbrella insurance to ensure comprehensive coverage.

Is it necessary for small business owners to have both general liability insurance and property insurance?

Yes, having both general liability insurance to cover third-party claims and property insurance to protect business assets is essential for small business owners to mitigate risks effectively.

How can small business owners determine the right amount of coverage for their property?

Small business owners should assess the value of their property, including equipment, inventory, and buildings, to determine the appropriate coverage amount needed to rebuild or replace these assets in case of damage or loss.

What does business interruption insurance typically cover?

Business interruption insurance typically covers lost income, ongoing expenses, and temporary relocation costs in the event that a business is forced to close temporarily due to a covered peril, such as a natural disaster.

Are there any government-mandated requirements for small businesses regarding insurance?

Depending on the location and type of business, small business owners may be required to have certain types of insurance, such as workers’ compensation insurance or commercial auto insurance, to comply with legal regulations.