With best accounting software for tech startups at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

As tech startups navigate the complex world of finance, having the right accounting software can make all the difference in managing their financial processes efficiently and effectively.

Importance of Accounting Software for Tech Startups

Accounting software plays a crucial role in the success of tech startups by providing efficient financial management tools and insights that help in making informed decisions.

Streamlining Financial Processes

Accounting software can streamline financial processes for tech startups by automating tasks such as invoicing, expense tracking, and financial reporting. This automation saves time, reduces errors, and allows founders to focus on growing their business.

Benefits of Specialized Accounting Software

- Improved Financial Visibility: Specialized accounting software provides real-time insights into the company’s financial health, helping founders make data-driven decisions.

- Scalability: As tech startups grow, specialized accounting software can scale with them, handling increased transactions and complexities without the need for manual intervention.

- Compliance: Specialized accounting software helps tech startups stay compliant with tax regulations and financial reporting standards, reducing the risk of penalties and fines.

- Integration with Other Tools: Many accounting software solutions for tech startups offer integrations with other business tools such as CRM systems and project management software, creating a seamless workflow.

Key Features to Look for in Accounting Software

When choosing accounting software for a tech startup, it’s crucial to consider the key features that will streamline financial processes and support business growth. Here are some essential features to look for:

Automation

Automation is a key feature that can save time and reduce errors in financial tasks. Look for accounting software that automates processes such as invoicing, expense tracking, and reconciliation to improve efficiency.

Scalability

Scalability is vital for tech startups that anticipate rapid growth. Choose accounting software that can scale with your business, accommodating increased transaction volumes and complexity as your company expands.

Integrations

Integration capabilities are crucial for seamless data flow between different business systems. Opt for accounting software that integrates with other tools and platforms used by your tech startup, such as CRM systems, project management software, and e-commerce platforms.

Real-Time Reporting

Real-time reporting allows tech startups to access up-to-date financial information and make data-driven decisions quickly. Look for accounting software that provides customizable dashboards and reports for real-time insights into your company’s financial performance.

Forecasting

Forecasting features enable tech startups to plan for the future and make informed decisions based on financial projections. Choose accounting software that offers forecasting tools to help you analyze trends, predict cash flow, and set realistic goals for growth.

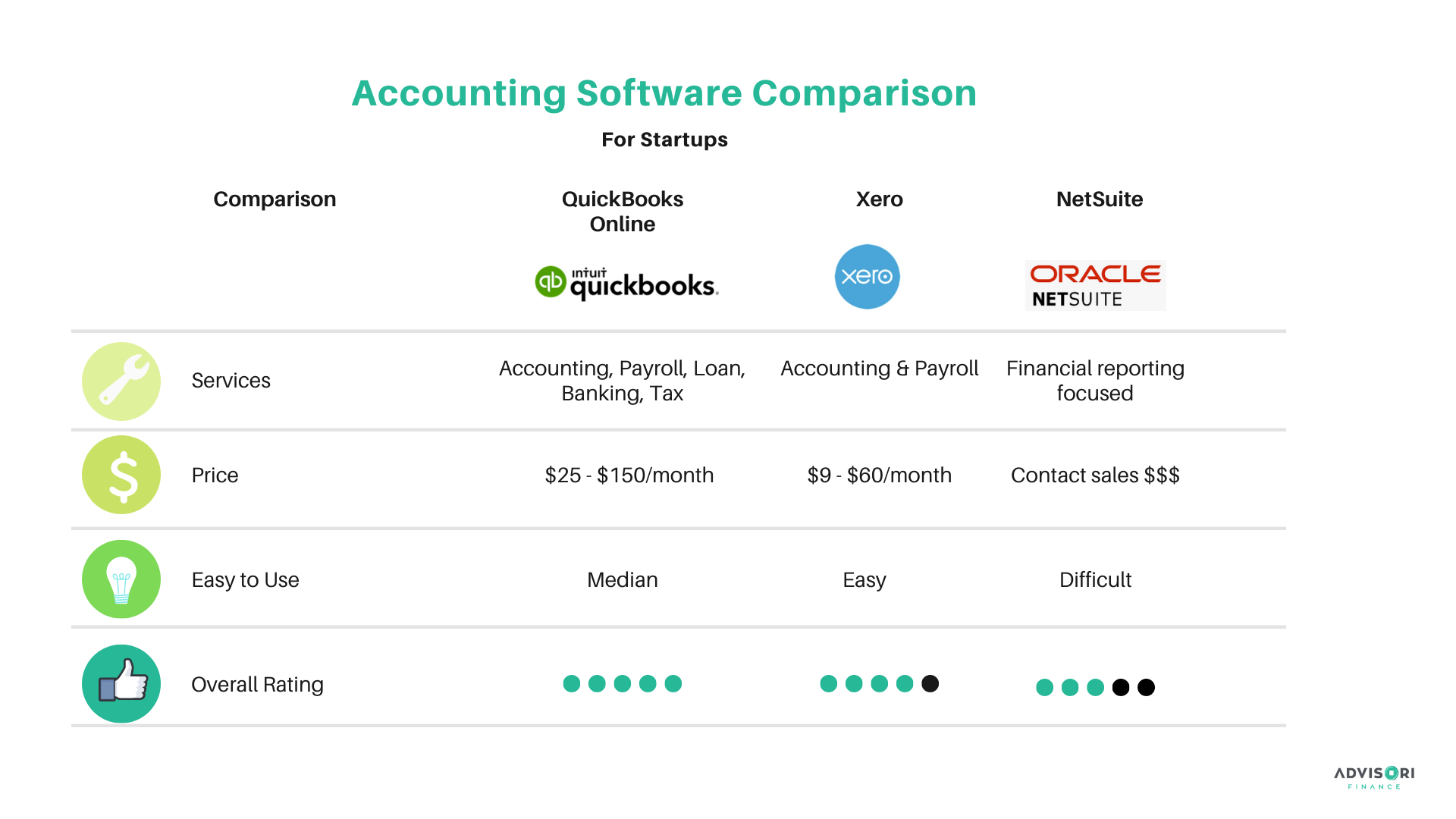

Top Accounting Software Options for Tech Startups

When it comes to managing finances, tech startups need reliable accounting software to streamline their operations. Here are some of the top accounting software options tailored for tech startups:

1. QuickBooks Online, Best accounting software for tech startups

QuickBooks Online is a popular choice among tech startups due to its user-friendly interface and robust features. Pricing plans start at $25 per month and can scale up based on the needs of the business. Users appreciate the ease of use and the ability to track expenses, send invoices, and generate financial reports seamlessly.

2. Xero

Xero is another top accounting software option for tech startups, offering features like bank reconciliation, expense tracking, and inventory management. Pricing plans start at $20 per month and can accommodate businesses of all sizes. Users praise Xero for its automation capabilities and integration with other business tools.

3. FreshBooks

FreshBooks is known for its intuitive design and time-saving features, making it a great choice for tech startups. Pricing plans start at $15 per month and include features like invoicing, expense tracking, and project management. Users love the user-friendly interface and excellent customer support provided by FreshBooks.

4. Wave

Wave is a free accounting software option that is ideal for tech startups looking to minimize costs. While it lacks some advanced features compared to paid software, Wave offers essential tools like invoicing, expense tracking, and financial reporting. Users appreciate Wave for its affordability and simplicity.

5. Zoho Books

Zoho Books is a comprehensive accounting software solution that caters to tech startups with features like project management, inventory tracking, and automated workflows. Pricing plans start at $9 per month and offer scalability as the business grows. Users find Zoho Books easy to use and appreciate its integration with other Zoho applications.

These accounting software options provide tech startups with the tools they need to manage their finances efficiently and effectively. Each software offers unique features and pricing plans to suit different business needs, making it easier for startups to focus on growth and innovation.

Implementation and Integration of Accounting Software

Implementing and integrating accounting software is crucial for the smooth financial operations of a tech startup. It helps in streamlining processes, improving accuracy, and providing real-time insights for better decision-making.

Steps for Implementing Accounting Software

- Assess the needs of your tech startup: Identify the specific accounting requirements and goals to choose the right software.

- Select the appropriate accounting software: Research and compare different options based on features, pricing, and scalability.

- Customize and set up the software: Tailor the software to meet the unique needs of your tech startup and configure settings accordingly.

- Import existing data: Transfer financial data from previous systems or spreadsheets to ensure a smooth transition.

- Train your team: Provide adequate training to employees to effectively use the accounting software and maximize its benefits.

- Regularly review and update: Continuously monitor the software performance, update settings, and adapt to changing business requirements.

Tips for Integrating Accounting Software with Other Tools

- Choose compatible tools: Select software that seamlessly integrates with your accounting system to avoid data inconsistencies.

- Automate data transfer: Utilize integrations or APIs to automate the transfer of data between different tools and the accounting software.

- Ensure data security: Implement robust security measures to protect sensitive financial information during integration processes.

- Regularly test integrations: Conduct regular tests to ensure that all integrated tools are working correctly and data is accurately synchronized.

Potential Challenges and Solutions

- Data migration issues: Address data compatibility issues by cleaning and organizing data before migration to prevent errors.

- Lack of training: Provide comprehensive training to employees to ensure they can effectively use the new accounting software.

- Integration complexities: Seek assistance from experts or support teams to resolve integration challenges and optimize system performance.

- Resistance to change: Communicate the benefits of the new accounting software to employees and involve them in the implementation process to increase acceptance.

Final Thoughts

In conclusion, finding the best accounting software for tech startups is crucial for ensuring smooth financial operations and strategic decision-making in the fast-paced tech industry.

Questions Often Asked: Best Accounting Software For Tech Startups

What are some key features to look for in accounting software for tech startups?

Essential features include automation, scalability, integrations, real-time reporting, and forecasting capabilities.

Which are some popular accounting software options tailored for tech startups?

Some popular options include Xero, QuickBooks Online, FreshBooks, and Wave.

How can accounting software streamline financial processes for tech startups?

By automating tasks, providing real-time insights, and offering scalable solutions for growing businesses.

What are some potential challenges when transitioning to new accounting software?

Challenges may include data migration issues, training employees on the new system, and ensuring compatibility with existing tools.