How much is auto insurance in Massachusetts? This query sets the stage for a comprehensive exploration of various factors influencing insurance rates, average costs, mandatory requirements, and money-saving tips within the state.

Delve into the specifics of what determines insurance premiums and the essential coverage needed to drive legally in Massachusetts.

Factors Affecting Auto Insurance Rates in Massachusetts

When it comes to determining auto insurance rates in Massachusetts, several factors come into play. Understanding how these factors affect your premiums can help you make informed decisions when selecting coverage.

Location Impact on Auto Insurance Rates

The location of the insured individual is a significant factor that influences auto insurance rates in Massachusetts. Urban areas with higher population density and increased traffic congestion tend to have higher rates compared to rural areas. This is due to the higher likelihood of accidents and theft in urban settings.

Driving History and Age

Your driving history and age also play a crucial role in determining insurance premiums. Individuals with a history of accidents or traffic violations are considered higher risk drivers and may face higher insurance rates. Additionally, younger drivers, especially those under the age of 25, typically pay more for auto insurance due to their lack of driving experience.

Type of Coverage Chosen

The type of coverage chosen can significantly influence the cost of auto insurance in Massachusetts. Opting for comprehensive coverage that includes protection against a wide range of risks will result in higher premiums compared to basic liability coverage. It’s essential to assess your individual needs and financial situation to determine the most suitable coverage for you.

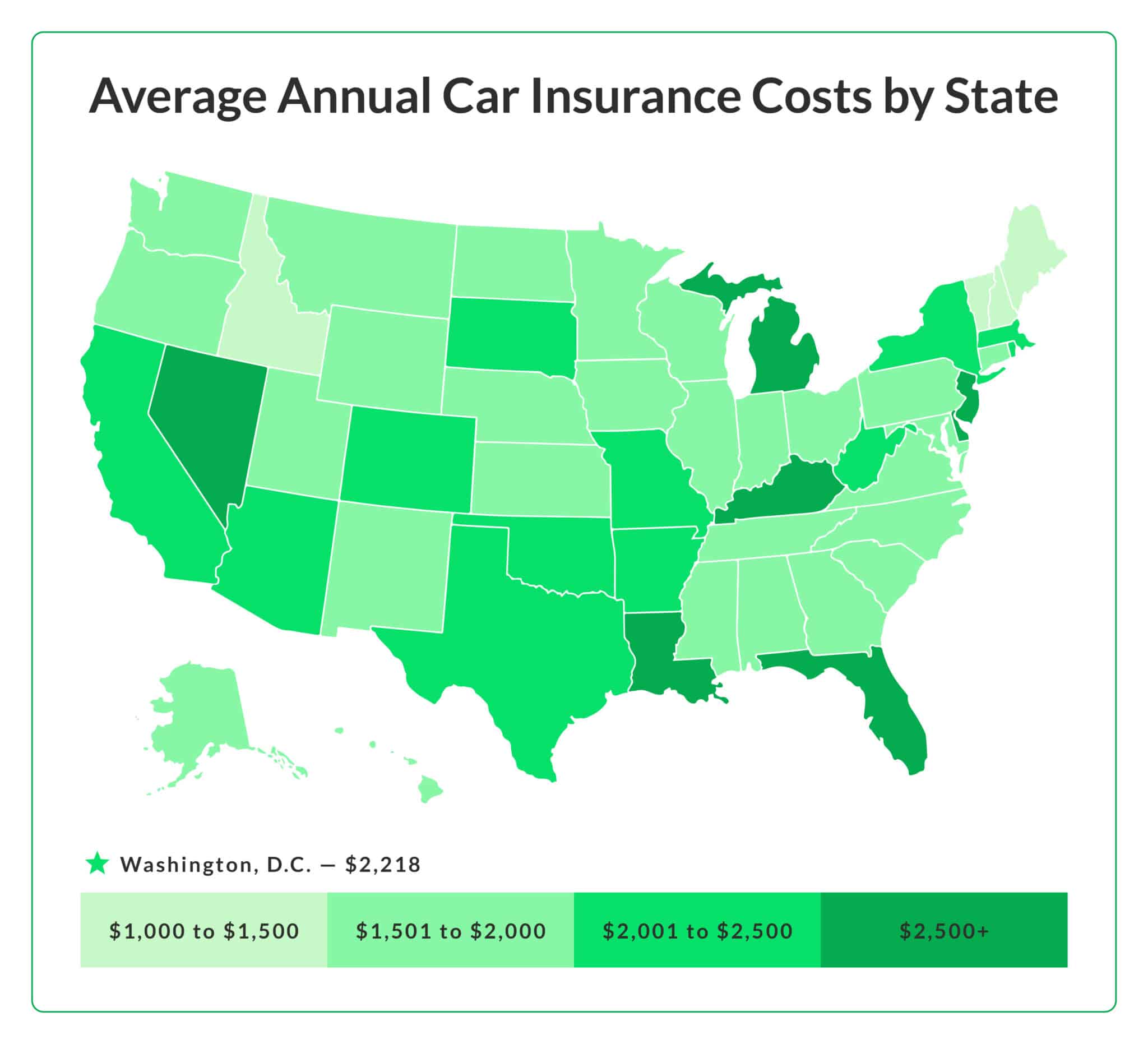

Average Cost of Auto Insurance in Massachusetts

In Massachusetts, the average annual auto insurance premium is around $1,200.

Insurance Costs in Urban vs. Rural Areas

When it comes to auto insurance costs, urban areas in Massachusetts tend to have higher premiums compared to rural areas. This is mainly due to factors such as higher population density, increased traffic congestion, and a higher likelihood of accidents in urban settings.

Trends in Auto Insurance Pricing

Over the past few years, there has been a noticeable trend of auto insurance rates increasing in Massachusetts. This could be attributed to various factors such as rising costs of vehicle repairs, medical expenses related to accidents, and changes in driving behaviors leading to more accidents.

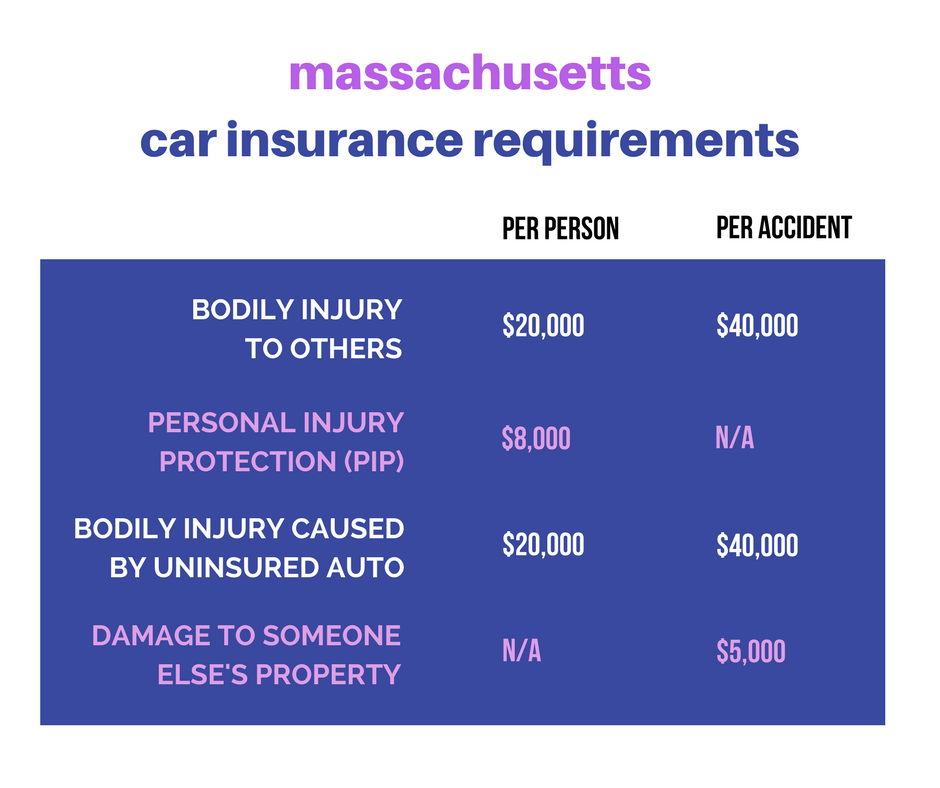

Mandatory Auto Insurance Requirements in Massachusetts

In Massachusetts, drivers are required by law to carry a minimum amount of liability insurance to cover any damages or injuries they may cause in an accident. This includes:

Minimum Liability Coverage

- Bodily Injury Liability: $20,000 per person and $40,000 per accident.

- Property Damage Liability: $5,000 per accident.

Additional Coverage Options, How much is auto insurance in massachusetts

While the minimum liability coverage is mandatory, there are additional coverage options that are commonly recommended for drivers in Massachusetts. These may include:

- Uninsured/Underinsured Motorist Coverage: Protects you if you are in an accident with a driver who has insufficient or no insurance.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers, regardless of fault.

- Collision Coverage: Pays for damages to your own vehicle in the event of an accident.

- Comprehensive Coverage: Covers non-accident related damages such as theft, vandalism, or natural disasters.

Consequences for Driving Without Insurance

Driving without insurance in Massachusetts can lead to severe consequences, including:

- Fines: First offense can result in a fine of $500 to $5,000, possible license suspension, and registration revocation.

- SR-22 Requirement: If caught driving without insurance, you may be required to file an SR-22 form with the state for three years, indicating you have the necessary coverage.

- Legal Penalties: You may face legal action, including being held responsible for damages and injuries if you cause an accident without insurance.

Ways to Save on Auto Insurance in Massachusetts

When it comes to auto insurance in Massachusetts, there are several ways you can save money on your premiums. Insurance providers in the state often offer various discounts to help policyholders lower their costs. Additionally, bundling policies and improving driving habits can also have a significant impact on reducing insurance rates.

Different Discounts Available from Insurance Providers in Massachusetts

- Multi-policy discount: By bundling your auto insurance with another policy, such as homeowners or renters insurance, you can often qualify for a discount on both policies.

- Good driver discount: Maintaining a clean driving record with no accidents or traffic violations can help you qualify for lower insurance rates.

- Good student discount: Students with good grades may be eligible for a discount on their auto insurance premiums.

- Safety features discount: Installing safety features in your vehicle, such as anti-theft devices or airbags, can lead to a discount on your insurance policy.

- Low mileage discount: If you drive fewer miles than the average driver, you may be able to save on your auto insurance premiums.

The Impact of Bundling Policies on Reducing Insurance Costs

When you bundle your auto insurance with another policy, such as homeowners or renters insurance, insurance providers often reward you with a discount on both policies. This can result in significant savings on your overall insurance costs.

Tips for Improving Driving Habits to Qualify for Lower Insurance Rates

- Follow traffic laws: Avoiding speeding tickets and other traffic violations can help you maintain a clean driving record and qualify for lower insurance rates.

- Take a defensive driving course: Completing a defensive driving course can not only improve your driving skills but also make you eligible for a discount on your auto insurance premiums.

- Drive less: If possible, try to reduce your mileage by carpooling, using public transportation, or walking for short distances. Lower mileage often translates to lower insurance rates.

- Maintain your vehicle: Regular maintenance and servicing of your vehicle can help prevent accidents and breakdowns, leading to a lower risk profile and potentially lower insurance premiums.

Final Wrap-Up

In conclusion, understanding the nuances of auto insurance in Massachusetts is crucial for making informed decisions and securing the right coverage. Dive deep into the details to ensure you are well-equipped for any driving scenario in the state.

Popular Questions: How Much Is Auto Insurance In Massachusetts

What factors affect auto insurance rates in Massachusetts?

Factors such as location, driving history, age, and type of coverage chosen play a significant role in determining insurance premiums in Massachusetts.

What are the mandatory auto insurance requirements in Massachusetts?

Massachusetts law requires drivers to have minimum liability coverage. Additional coverage options are also available, and driving without insurance can lead to serious consequences.

How can one save on auto insurance in Massachusetts?

Insurance providers offer various discounts, and bundling policies can help reduce costs. Improving driving habits is another way to qualify for lower insurance rates.