Ohio insurance rates are influenced by various factors, from demographics to coverage options. Discover how these factors impact insurance premiums and how residents can lower their rates effectively.

Explore the top insurance providers in Ohio, unique offerings, and discounts available to residents, along with an analysis of the regulatory environment shaping insurance rates in the state.

Factors influencing Ohio insurance rates

When it comes to determining insurance rates in Ohio, several factors come into play, impacting how much individuals pay for coverage.

Demographics

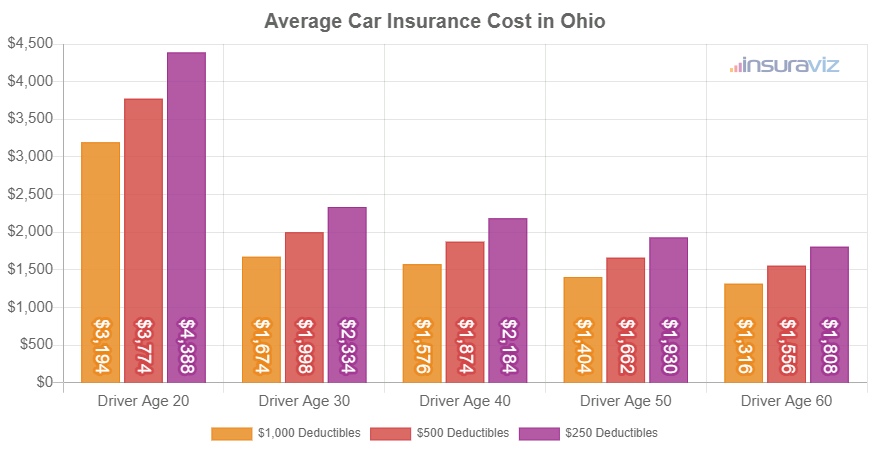

Demographic factors such as age, gender, and marital status can influence insurance rates in Ohio. For example, younger drivers are often charged higher premiums due to their lack of driving experience, while married individuals tend to receive lower rates as they are seen as more responsible.

Driving Records

A person’s driving record plays a significant role in determining insurance rates in Ohio. Those with a history of accidents or traffic violations are considered higher risk and are likely to pay more for coverage compared to drivers with clean records.

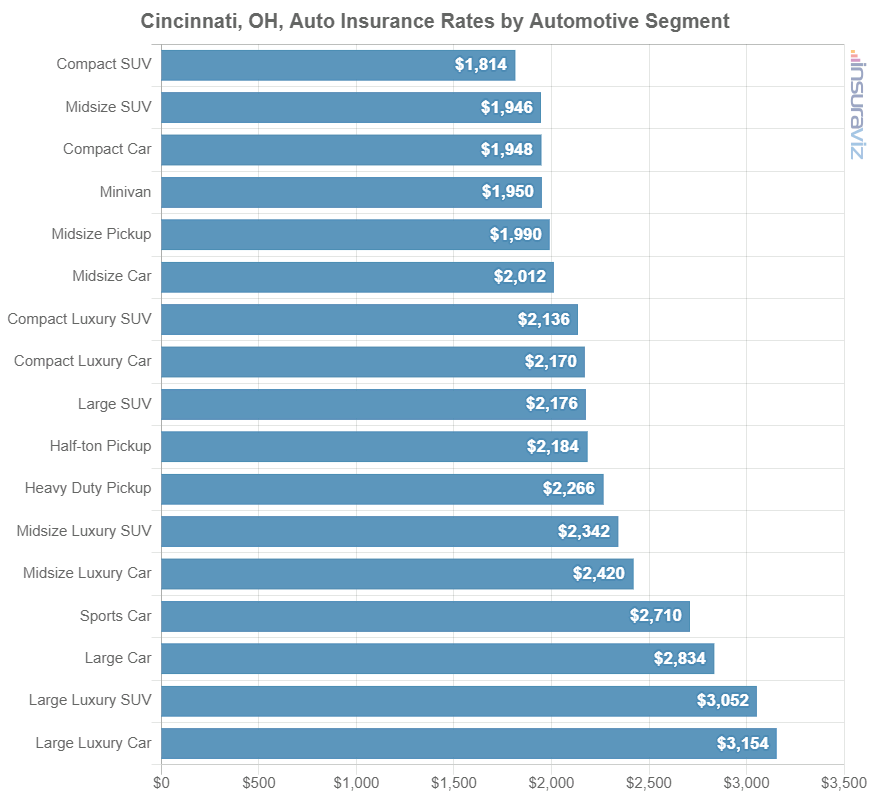

Coverage Options

The type and amount of coverage selected also impact insurance rates in Ohio. Comprehensive coverage with lower deductibles will result in higher premiums, while opting for basic liability coverage may lead to more affordable rates.

Urban vs. Rural Areas

Insurance rate trends can vary between urban and rural areas in Ohio. Urban areas typically have higher rates due to increased traffic congestion, higher crime rates, and greater likelihood of accidents. On the other hand, rural areas may have lower rates as there is less traffic and lower risk of theft or vandalism.

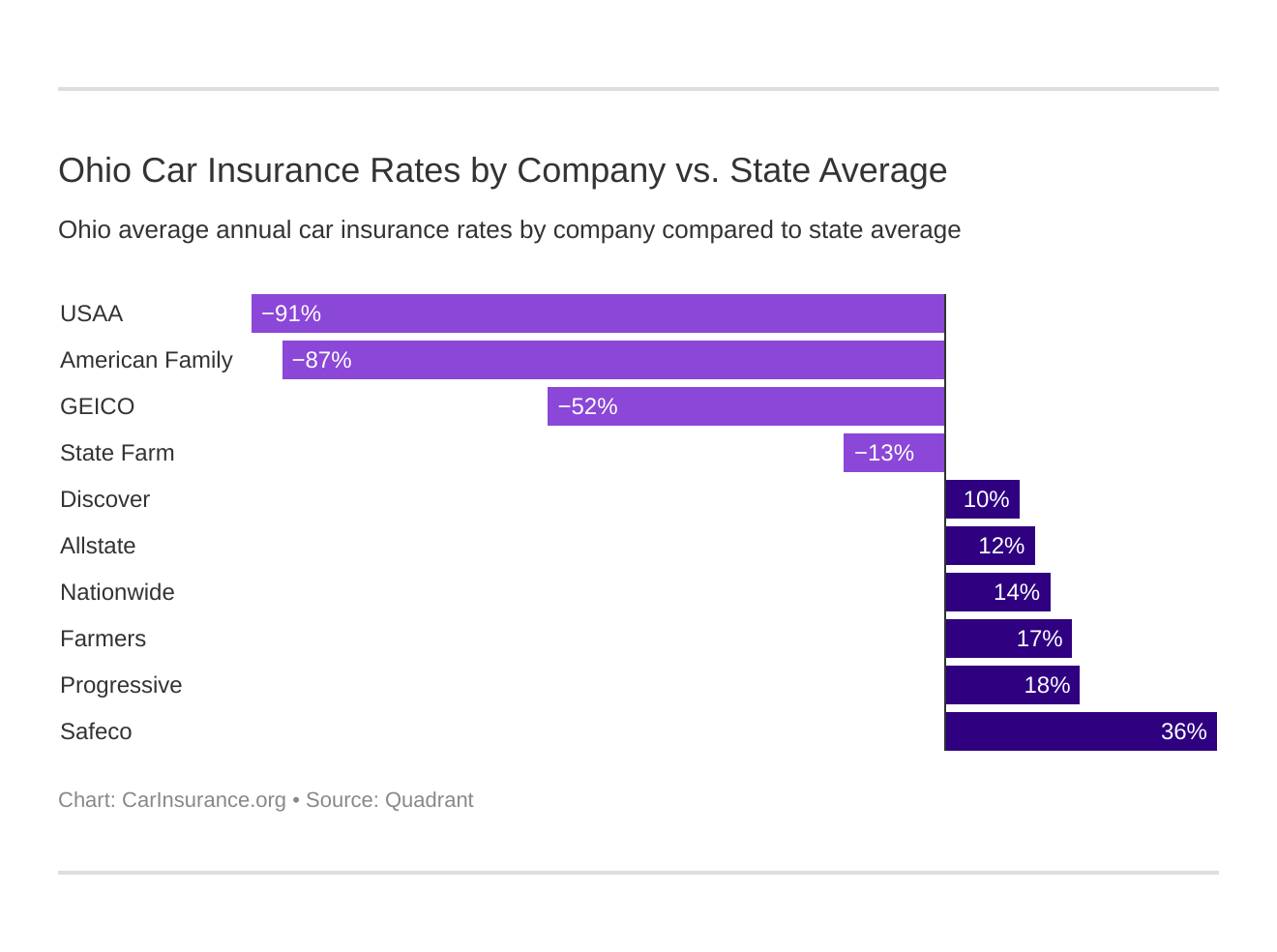

Popular insurance providers in Ohio

Ohio is home to several top insurance companies that offer a wide range of coverage options to meet the needs of residents. These insurance providers have established a strong presence in the state and are known for their reliability and customer service.

When it comes to choosing an insurance provider, the reputation and financial stability of the company play a significant role in determining the rates. Insurance companies with a solid reputation and a strong financial standing are often able to offer competitive rates to their customers. This is because they have the resources to cover claims and provide excellent customer service, which can result in lower premiums for policyholders.

In Ohio, some insurance providers also offer unique offerings and discounts to attract customers. For example, some companies may provide discounts for bundling multiple policies such as auto and home insurance. Others may offer discounts for safe driving habits or for installing home security systems. These special offerings and discounts can help policyholders save money while still receiving the coverage they need.

Overall, choosing a reputable and financially stable insurance provider in Ohio can help you secure the best rates and coverage options for your needs.

Tips for lowering insurance rates in Ohio

Lowering insurance rates in Ohio can help residents save money while still maintaining adequate coverage. By implementing certain strategies, individuals can reduce their insurance premiums and potentially enjoy more affordable rates. Below are some tips to consider:

Bundling Policies, Ohio insurance rates

- Combining multiple insurance policies, such as auto and home insurance, with the same provider can often lead to discounted rates.

- Insurance companies may offer special deals or incentives for bundling policies, making it a cost-effective option for Ohio residents.

Improving Driving Habits

- Safe driving practices, such as avoiding accidents and traffic violations, can help individuals qualify for lower insurance rates.

- Participating in defensive driving courses or programs can also demonstrate a commitment to safe driving and potentially result in reduced premiums.

Comparison Shopping

- Obtaining quotes from multiple insurance providers allows Ohio residents to compare rates and coverage options to find the most affordable policy.

- Regularly reviewing and updating insurance policies can help individuals take advantage of new discounts or promotions offered by different providers.

Regulatory environment and insurance rates in Ohio

Ohio’s insurance rates are heavily influenced by the state’s regulatory environment. State regulations play a crucial role in determining insurance pricing and ensuring that consumers are protected.

Impact of Ohio insurance laws

Recent changes in Ohio insurance laws can have a significant impact on insurance rates. For example, updates in regulations regarding coverage requirements or claims processing can directly affect the cost of insurance for Ohio residents.

Regulatory oversight in Ohio

The regulatory bodies in Ohio, such as the Ohio Department of Insurance, closely monitor and control insurance rates to safeguard consumers. These regulatory agencies work to prevent unfair pricing practices and ensure that insurance companies adhere to state laws and regulations.

Conclusive Thoughts: Ohio Insurance Rates

In conclusion, understanding the intricacies of Ohio insurance rates is crucial for making informed decisions. By leveraging the tips provided and staying informed about regulatory changes, residents can navigate the insurance landscape effectively.

FAQs

How do demographics impact insurance rates in Ohio?

Different age groups and locations within Ohio can influence insurance premiums. Younger drivers and urban areas may have higher rates due to increased risk factors.

What are some strategies for lowering insurance rates in Ohio?

Residents can bundle policies, maintain a clean driving record, and explore discounts offered by insurance providers to reduce their premiums.

How do state regulations affect insurance pricing in Ohio?

State regulations play a significant role in determining insurance rates by setting guidelines for insurers. Changes in laws can impact rates and consumer protection measures.