Personal insurance meaning sets the foundation for protecting yourself and your assets. Let’s delve into the world of personal insurance to grasp its significance and benefits.

Definition of Personal Insurance

Personal insurance refers to a type of coverage that individuals purchase to protect themselves and their loved ones from financial losses in the event of unexpected circumstances. The primary purpose of personal insurance is to provide a sense of security and peace of mind by ensuring that policyholders are financially protected in times of need.

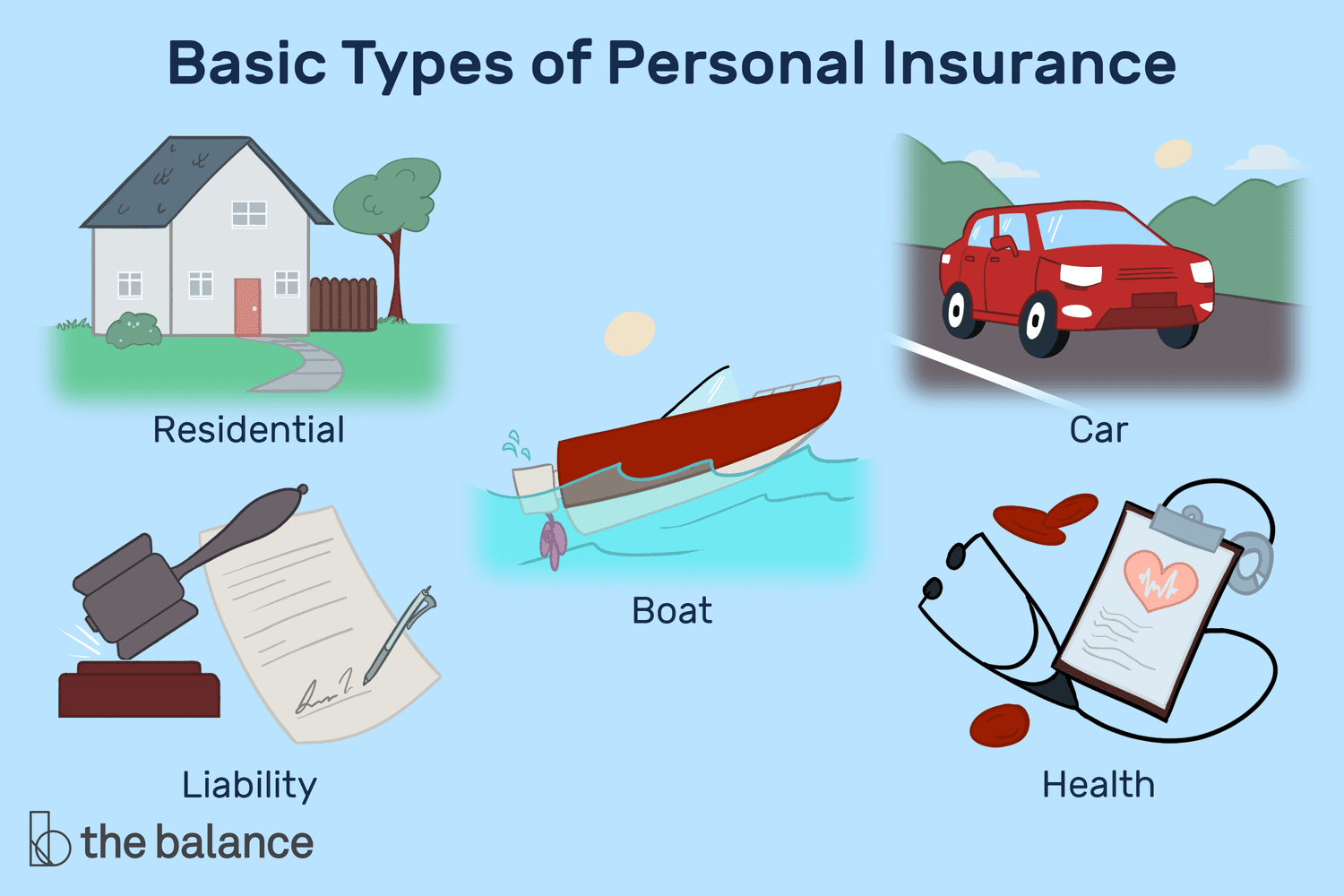

Common Types of Personal Insurance

- Health Insurance: This type of insurance helps cover medical expenses, including doctor visits, hospital stays, prescription medications, and other healthcare services.

- Life Insurance: Life insurance provides a financial benefit to the beneficiaries of the policyholder in the event of their death, helping to replace lost income and cover expenses.

- Auto Insurance: Auto insurance protects policyholders from financial losses related to car accidents, theft, or damage to their vehicles.

- Homeowners Insurance: Homeowners insurance covers damage to a policyholder’s home and personal belongings, as well as liability for injuries that occur on the property.

Importance of Having Personal Insurance Coverage

Having personal insurance coverage is essential for individuals and families to safeguard their financial well-being. It provides a safety net in case of unforeseen events, such as accidents, illnesses, or natural disasters, that could otherwise result in significant financial hardship. By investing in personal insurance, individuals can protect themselves and their loved ones from the potentially devastating financial consequences of unexpected events.

Key Components of Personal Insurance

Personal insurance policies typically consist of several key components that provide coverage and protection for individuals and their assets.

Types of Personal Insurance

- Property Insurance: Protects against damage or loss of personal property due to events like fire, theft, or natural disasters.

- Health Insurance: Covers medical expenses and treatments for illnesses or injuries.

- Auto Insurance: Provides coverage for damages or injuries resulting from car accidents.

- Life Insurance: Offers financial protection for the family in the event of the policyholder’s death.

Deductibles, Premiums, and Coverage Limits

When it comes to personal insurance, deductibles, premiums, and coverage limits play a crucial role in determining the extent of protection and the cost of the policy.

Deductible: The amount the policyholder must pay out of pocket before the insurance coverage kicks in.

Premium: The amount paid by the policyholder to the insurance company in exchange for coverage.

Coverage Limits: The maximum amount the insurance company will pay out for a covered claim.

Benefits of Personal Insurance

Having personal insurance offers a range of benefits that provide individuals with peace of mind and financial security in times of need. Below are some key advantages of having personal insurance:

Financial Protection

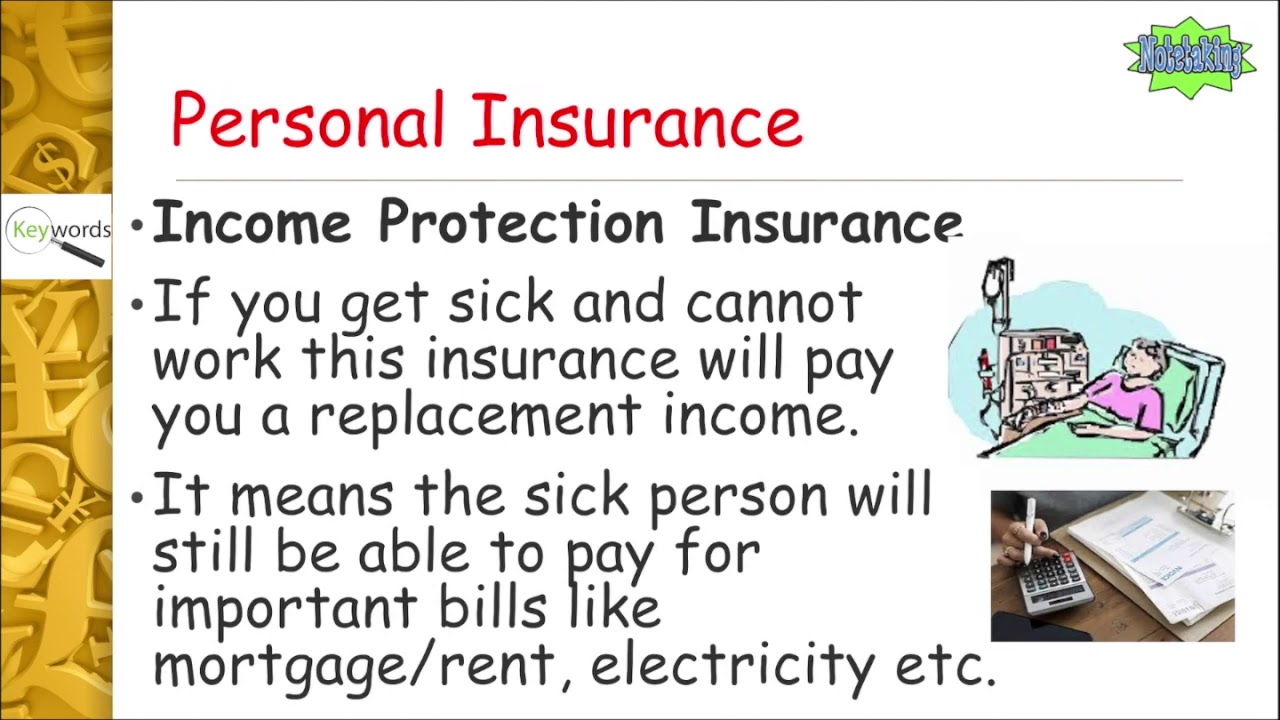

Personal insurance provides financial protection by covering unexpected expenses such as medical bills, property damage, or liability claims. In case of accidents, illnesses, or other unforeseen events, having insurance can prevent individuals from facing financial hardships.

Peace of Mind, Personal insurance meaning

Knowing that you are covered by personal insurance can give you peace of mind, allowing you to focus on other aspects of your life without constantly worrying about potential risks. This sense of security can be invaluable in reducing stress and anxiety.

Family Security

Personal insurance helps ensure the financial security of your family members in case of your disability, illness, or death. Life insurance, for example, can provide your loved ones with a financial safety net, covering expenses and maintaining their quality of life in your absence.

Long-Term Savings

Certain types of personal insurance, such as retirement or investment-linked policies, can serve as long-term savings vehicles, helping individuals build wealth and secure their financial future. These policies offer a combination of protection and investment growth.

Access to Healthcare

Health insurance is a key component of personal insurance that provides individuals with access to essential healthcare services, including doctor visits, hospitalization, and prescription medications. It ensures that you can receive timely medical treatment without worrying about prohibitive costs.

Real-Life Examples

– A family facing a major medical emergency was able to cover the high treatment costs thanks to their health insurance policy, avoiding significant financial strain.

– A homeowner whose property was damaged by a natural disaster received compensation from their property insurance, allowing them to repair and rebuild without bearing the full financial burden.

In conclusion, personal insurance offers numerous benefits that extend beyond mere financial protection. It provides peace of mind, family security, long-term savings opportunities, access to essential services, and real-life support in times of need. By investing in personal insurance, individuals can safeguard their well-being and secure their future against unforeseen risks.

Factors to Consider When Choosing Personal Insurance

When selecting personal insurance, there are several important factors to take into consideration to ensure you get the right coverage for your needs. Your individual requirements, lifestyle, and budget all play a crucial role in determining the most suitable insurance policy for you. It is also essential to regularly review and update your personal insurance policies to keep up with any changes in your circumstances or coverage options.

Individual Needs

- Consider your specific needs, such as health conditions, family size, and financial obligations.

- Assess the level of coverage required to provide adequate protection for yourself and your loved ones.

- Look for policies that offer customizable options to tailor the coverage to your individual requirements.

Lifestyle

- Take into account your lifestyle choices, such as hobbies, travel frequency, and occupation.

- Choose insurance that covers any risks associated with your activities or profession.

- Ensure the policy aligns with your lifestyle to avoid gaps in coverage that could leave you vulnerable.

Budget

- Determine how much you can afford to pay for insurance premiums without straining your finances.

- Compare quotes from different insurance providers to find a policy that fits within your budget.

- Avoid compromising on coverage for a lower premium, as inadequate insurance may lead to financial difficulties in the future.

Regular Review and Update

- Periodically review your insurance policies to ensure they still meet your needs and offer adequate coverage.

- Update your policies when experiencing major life events, such as marriage, childbirth, or purchasing a new home.

- Consult with your insurance agent or broker to make adjustments to your coverage as needed.

Summary

In conclusion, personal insurance offers a vital safety net that provides peace of mind and financial security in times of need. Understanding the nuances of personal insurance can lead to informed decisions and better protection for the future.

Q&A: Personal Insurance Meaning

What does personal insurance cover?

Personal insurance typically covers health, life, auto, and homeowners insurance to protect individuals and their assets.

How does personal insurance provide financial security?

Personal insurance offers financial security by covering unexpected expenses and losses, ensuring individuals are not left in a vulnerable financial state.

Why is it important to review personal insurance policies regularly?

Regularly reviewing personal insurance policies ensures that coverage aligns with current needs and circumstances, preventing gaps in protection.