SAG accounting software revolutionizes financial management by offering advanced features tailored for businesses of all sizes. Dive into the world of efficient accounting solutions with SAG accounting software at your fingertips.

Explore the essential components, implementation strategies, security measures, and customer support options that make SAG accounting software a game-changer in the industry.

Overview of SAG Accounting Software

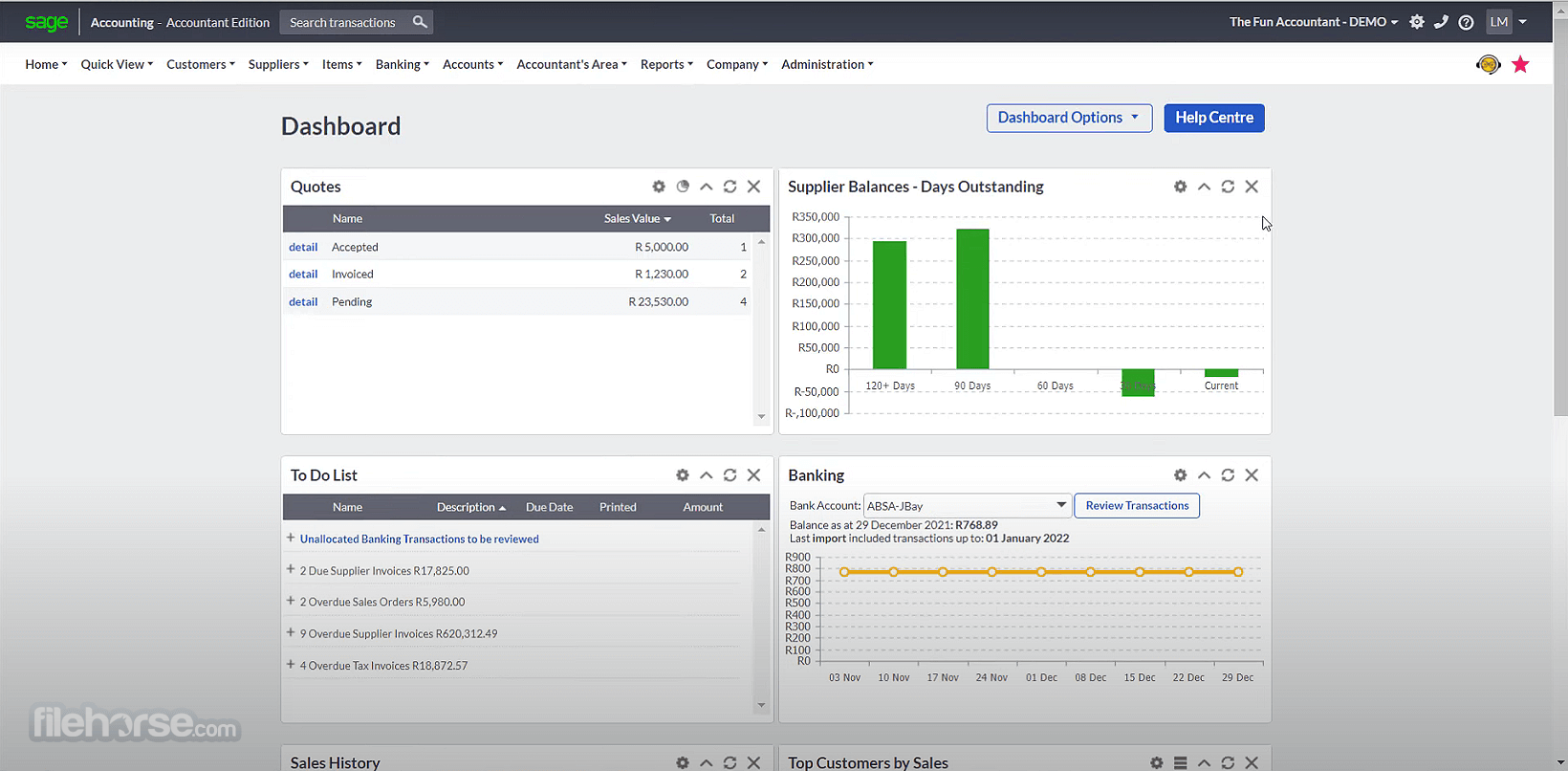

SAG Accounting Software is a comprehensive financial management solution designed to streamline accounting processes for businesses of all sizes. With a range of features tailored to meet the needs of modern businesses, SAG Accounting Software is a valuable tool for ensuring accurate financial reporting and efficient operations.

Core Features of SAG Accounting Software

- Automated Bookkeeping: SAG Accounting Software automates the bookkeeping process, saving time and reducing errors in financial data entry.

- Financial Reporting: Generate detailed financial reports with ease, allowing for better analysis of business performance and trends.

- Invoicing and Billing: Create professional invoices and manage billing processes seamlessly within the software.

- Inventory Management: Keep track of inventory levels, orders, and sales to optimize stock levels and improve supply chain management.

- Bank Reconciliation: Easily reconcile bank statements with accounting records to ensure accuracy in financial transactions.

Target Market for SAG Accounting Software

SAG Accounting Software is ideal for small to medium-sized businesses looking to improve their financial management processes. It caters to a wide range of industries, including retail, manufacturing, services, and more. Whether you are a startup or an established company, SAG Accounting Software can help you streamline your accounting operations effectively.

Benefits of Using SAG Accounting Software for Businesses

- Increased Efficiency: By automating repetitive tasks and providing real-time data, SAG Accounting Software helps businesses operate more efficiently.

- Improved Accuracy: With built-in checks and balances, SAG Accounting Software reduces the risk of errors in financial reporting.

- Cost Savings: By optimizing financial processes and providing valuable insights, SAG Accounting Software can help businesses save money in the long run.

- Scalability: SAG Accounting Software grows with your business, allowing you to easily expand its functionality as your company evolves.

- Enhanced Decision-Making: Access to accurate financial data and reports enables better decision-making for strategic planning and business growth.

Key Components of SAG Accounting Software

SAG Accounting Software comes equipped with essential modules that cater to various financial and accounting needs of businesses. Let’s delve into the key components of SAG Accounting Software.

Essential Modules Included

- General Ledger: This module allows users to manage all financial transactions, including assets, liabilities, income, and expenses.

- Accounts Payable: Enables businesses to track and manage all outgoing payments to vendors and suppliers.

- Accounts Receivable: Helps in tracking and managing incoming payments from customers and clients.

- Inventory Management: Allows businesses to oversee their stock levels, orders, and deliveries efficiently.

- Payroll Processing: Facilitates the calculation of employee salaries, taxes, and benefits accurately.

Integration with Other Business Systems

SAG Accounting Software offers seamless integration capabilities with various business systems, such as CRM software, ERP systems, and e-commerce platforms. This integration ensures smooth data flow between different departments, eliminating the need for manual data entry and reducing errors.

Customization Options Available

Users can customize SAG Accounting Software according to their specific business requirements. From creating custom reports to setting up unique chart of accounts, the software provides flexibility to tailor the system to meet individual needs. Additionally, users can add or remove modules based on their changing business needs.

Implementation and Training for SAG Accounting Software

Implementing SAG accounting software in a business requires careful planning and execution to ensure a smooth transition. Training resources are essential to help users understand and utilize the software effectively.

Best Practices for Implementation

When implementing SAG accounting software, it is crucial to involve key stakeholders from the beginning to ensure buy-in and support. Create a detailed implementation plan with clear timelines and responsibilities. Conduct thorough testing before full deployment to catch any issues early on.

Training Resources Provided

- Online tutorials and user guides: SAG accounting software typically provides comprehensive online resources to help users learn the ins and outs of the system at their own pace.

- Training sessions: Companies offering SAG accounting software often conduct training sessions either virtually or in person to provide hands-on guidance and support to users.

- Customer support: A dedicated customer support team is usually available to answer any questions or troubleshoot issues that users may encounter while using the software.

Typical Timeline for Onboarding and Training

The timeline for onboarding and training when adopting SAG accounting software can vary depending on the complexity of the business and the level of customization required. On average, the onboarding process can take anywhere from a few weeks to a few months, including initial setup, training sessions, and continuous support as users familiarize themselves with the software.

Security and Compliance Features in SAG Accounting Software

When it comes to financial data security and regulatory compliance, SAG accounting software is equipped with robust features to safeguard sensitive information and ensure adherence to accounting standards.

Security Measures

SAG accounting software employs various security measures to protect financial data from unauthorized access or cyber threats. These measures may include:

- Role-based access control to restrict user permissions and limit access to sensitive data.

- Encrypted data transmission to secure information shared within the software and prevent interception.

- Regular data backups to prevent loss of financial information and ensure data recovery in case of emergencies.

Compliance with Accounting Regulations, Sag accounting software

Ensuring compliance with accounting regulations is crucial for businesses, and SAG accounting software assists in this aspect by:

- Automating compliance checks to identify any discrepancies or violations of accounting standards.

- Generating compliance reports to demonstrate adherence to regulatory requirements and facilitate audits.

- Providing audit trails to track changes made to financial data and maintain transparency in accounting practices.

Encryption and Data Protection

Encryption and data protection features offered by SAG accounting software include:

- Advanced encryption algorithms to secure sensitive financial information and prevent data breaches.

- Secure data storage to ensure that confidential data is stored securely and inaccessible to unauthorized users.

- Data masking capabilities to hide sensitive information within the software and protect privacy.

Customer Support and Service for SAG Accounting Software

Customer support is a crucial aspect of any software, including SAG Accounting Software. Users need reliable support options to address any issues that may arise during their use of the software.

Customer Support Options

- SAG Accounting Software provides users with multiple customer support channels, including email support, phone support, and a dedicated help center on their website.

- Users can also access user guides, FAQs, and video tutorials to troubleshoot common issues on their own.

Common Issues and Resolutions

- One common issue users may encounter is difficulty reconciling accounts. The customer support team can guide users through the reconciliation process step by step to resolve any discrepancies effectively.

- Another common issue is importing data from external sources. The support team can assist users in ensuring that the data is formatted correctly for successful import.

Responsiveness and Effectiveness

- The customer service team at SAG Accounting Software is known for its quick response times and knowledgeable support staff.

- Users have reported high satisfaction levels with the support provided, citing prompt resolutions and clear communication from the support team.

Wrap-Up

In conclusion, SAG accounting software emerges as the ideal tool for businesses seeking seamless financial operations, compliance, and exceptional customer service. Embrace the future of accounting software with SAG to elevate your business to new heights.

General Inquiries

Is SAG accounting software suitable for small businesses?

Yes, SAG accounting software is designed to cater to businesses of all sizes, including small enterprises.

Does SAG accounting software offer cloud-based solutions?

Yes, SAG accounting software provides cloud-based options for easy access and data security.

Can SAG accounting software integrate with existing business systems?

Absolutely, SAG accounting software seamlessly integrates with various business systems to streamline operations.